Altahawi's {Andy, a leading provider of innovative solutions, is set to make its public debut via a direct listing on the New York Stock Exchange (NYSE). This strategic move demonstrates the company's commitment to transparency and attracting access to capital. The direct listing process allows existing shareholders to sell their shares directly to the public, overcoming the traditional underwriter involvement seen in initial public offerings (IPOs).

Andy's direct listing is anticipated to happen on aspecific date|in the coming weeks, read more subject to market conditions and regulatory approval. The company plans to use the proceeds from the listing to fuel its growth initiatives, including new product launches.

The Company Elects Direct Listing on the NYSE

In a bold move, the company's founder, has chosen to launch a direct listing on the New York Stock Exchange (NYSE). This innovative approach facilitates investors to obtain shares of the company without an underwriter present. The decision comes as a departure from the traditional IPO method, and indicates Altahawi's belief in the company's strength.

The direct listing is anticipated to take place on athe coming months. The move has {generatedconsiderable interest in the market, with analysts predicting a strong response from investors.

NYSE Welcomes Andy Altahawi with Initial Public Offering Debut

Andy Altahawi's company made its much-anticipated entry onto the major New York Stock Exchange (NYSE) today, marking a significant milestone in the company's expansion. This unprecedented event saw Altahawi's company become one of the latest additions to the prestigious exchange, joining a exclusive group of successful businesses.

- The CEO is acknowledged for his leadership in the field.

- Observers are eager to see how Altahawi's company will thrive on the public market.

The direct listing represents a strategic step for Altahawi's company, granting it increased access to capital and boosting its exposure in the global marketplace.

Altahawi Embarks on a Bold Journey: Direct Listing on the NYSE

Altahawi is making waves in the financial world by selecting a direct listing on the New York Stock Exchange (NYSE). This unconventional move allows Altahawi to avoid the traditional IPO process, offering investors a direct opportunity to participate in its growth.

The move reflects Altahawi's dedication to accessibility, empowering its base to be immediately involved in the company's future. This historic event is set to propel a new era for Altahawi, driven by the collective strength of its supporters.

Andy Altahawi Makes Daring Play: Skipping IPO for NYSE Direct Listing

In a surprising turn of events, Andy Altahawi, the creator behind [Company Name], has opted to go public via a direct listing on the New York Stock Exchange (NYSE). This bold choice marks a departure from the traditional IPO process, where companies offer new shares to raise capital. Altahawi's choice of a direct listing underscores his confidence in the company's value and its ability to attract investors directly.

This move is perceived as a sign of Altahawi's ambition to reimagine the conventional system of going public. It will be fascinating to see how this novel approach unfolds in the coming months.

A Groundbreaking Debut on the NYSE

The financial world is buzzing with excitement as Andy Altahawi makes a remarkable milestone in history. In a move that has drawn the attention of investors and industry veterans alike, Altahawi has decided to execute a direct listing on the prestigious New York Stock Exchange (NYSE). This unprecedented approach bypasses the traditional IPO process, allowing Altahawi's company to list its shares directly on the exchange.

This bold move has set a example for other companies considering an alternative path to the public markets. The direct listing method offers several advantages, including lower costs and increased accountability. Altahawi's decision to venture this innovative strategy reflects his confidence in the company's future prospects and his vision to disrupt traditional business models.

The market is eagerly awaiting Altahawi's direct listing, as investors anticipate a substantial opportunity to participate in the growth of this potential company.

Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Amanda Bearse Then & Now!

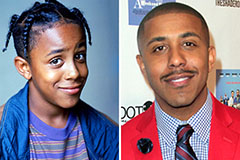

Amanda Bearse Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!